Is It time to take control of your finances?

This week I went out for brunch with a friend. After paying for my meal, I asked for the receipt as I usually do. As we were walking away, she questioned me about why I asked for the receipt. I indicated that I track everything (yes both personal and business) in relation to my finances so that I know where my money is going and be in control of my finances. She seemed surprised. However, this wasn’t always the way (you can read some of my adventure around money here, here, here and here).

In this post I am going to share with you how you can start to take control of your finances.

Why Take Control of Your Finances?

Currently there are a number of reasons why it is important for women to take control and focus and prioritise their money and finances. Some of the research states –

- The current national gender pay gap in Australia is 18.8%, which equates to men earning $298.10 per week more than women.

- The overall gender difference in superannuation balances was 45.7%, with the average man’s superannuation balance being nearly twice the size of the average woman’s (approximately $37,749 difference in average superannuation balances).

- Financial issues remain the leading cause of stress amongst Australians with more than half of Australians identifying finances as a cause of stress.

- Family and financial issues were the leading cause of stress for women.

- One in three marriages end in divorce.

These factors as well others can have an impact on the health and wellbeing of women, so it comes as little surprise that women are finding it increasingly difficult to find time to nurture their own financial wellbeing, so they can take time out and prioritise themselves.

The Inner Work and the Outer Work of Money

One thing I know for sure around money is that there is work required to get your money situation in order and work out what you have control over. The money work consists of –

- inner work – mind work (identifying your blocks, internal motivation and commitment), emotional work (i.e. self-compassion, forgiveness and emotional intelligence), body work (living in alignment with your gifts and making your contribution) and spiritual work (self-actualisation) and

- outer work – practical aspects of financial management (e.g. where your money is held, your tax, insurances and wills and the people who support you).

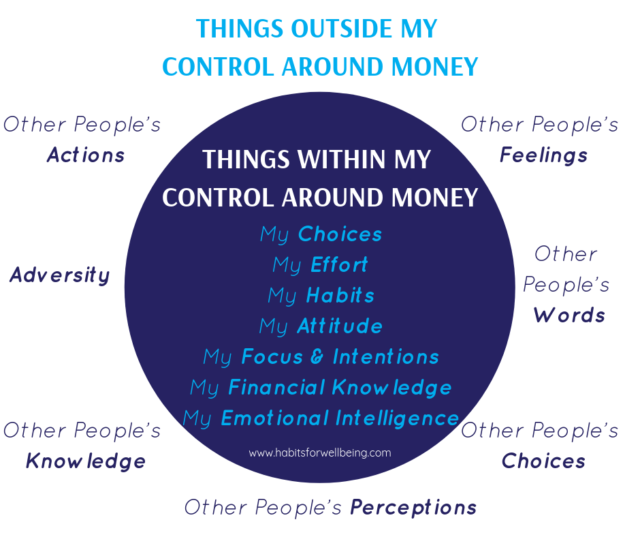

The Things Within Your Control Around Money

The following graphic shows the things we have control over in relation to money –

Where Are You Now In Relation to Your Finances?

The following statements, can help you to develop some insight in to where you currently are in relation to your finances. As the saying goes, the truth will set you free and on to your path of financial knowledge and freedom. If we don’t commit to telling the truth you can live in denial. A great acronym for Denial is –

“DENIAL – Don’t, Even, Notice, I, Am, Lying” ~ Unknown.

Telling the truth also brings with it tremendous power and clarity. With clarity and power (and your courage and self-compassion), change starts to happen and you are empowered to start making different choices. If you are committed to developing insight, read over the following 10 statements and answer them with a yes, no or N/A (not applicable).

- I have a detailed spending plan I work to,

- I track my expenses and income,

- I know how and where I am spending my money each month (within $100),

- I know where my income is coming from each month (within $100),

- I have income that comes in each month, even when I don’t work (i.e. real estate, stocks, business etc.),

- I know how much money I have in my bank account,

- I pay my expenses on time when they are due,

- My receipts, invoices and financial records are filed in order,

- I have a savings plan and aim to save at least 10% of my income, and

- I pay my taxes on time each year.

If you would like the other 23 statements I have created, please click here (it is in the free preview).

Next Step…

Once you have answered the statements, you can see which areas require the most attention to take control of your finances. Then you can focus on your own tiny tweaks to bring about change!

How Will You Take Control of Your Finances?

I hope this post has given you some guidance and inspiration on how to start taking control of your finances, so you can move towards your dreams! Remember, tiny tweaks everyday will take you there 🙂

If you are ready to reclaim your courage and take the next step towards freedom and opening your heart, why not join our Toolkit? And remember, you can download the worksheet Reconnecting with Your Finances here (in the free preview)!

Leave A Response